According to a report from Chainalysis, 2022 cryptocurrency mixers use have reached an all-time high in 2022.

Chainalysis is a member of the World Economic Forum’s (WEF) Global Innovators community, Chainalysis is a leader in blockchain analytics. They are an extension of governments, they provide services to law enforcement agencies and hire former feds as employees.

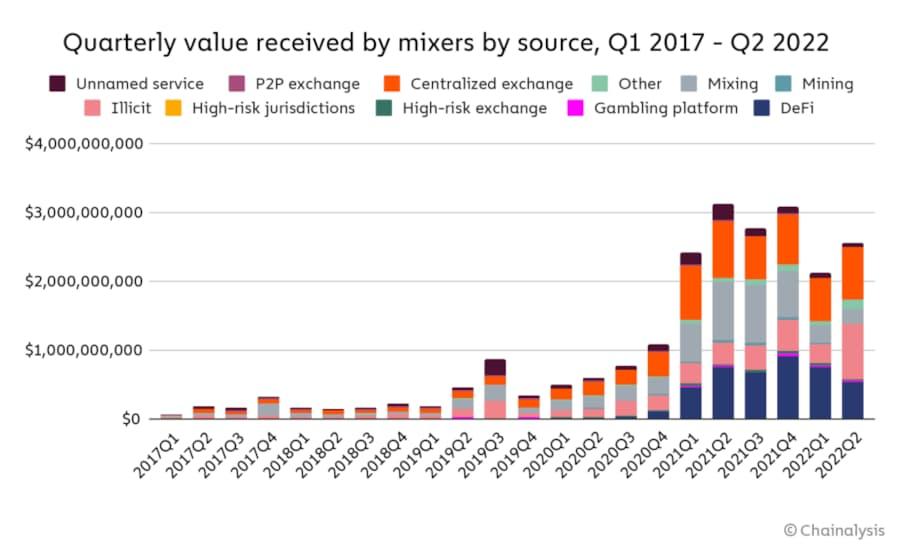

According to the firm, crypto mixers are receiving record amounts of cryptocurrency in 2021 and 2022. According to the Chainalysis report published on July 14, 2022, on April 19, 2022, crypto mixers received “an all-time high of $51.8 million worth of cryptocurrency.” A chart provided by Chainalysis reveals that mixers received roughly $24 million worth of cryptocurrency on the same day in 2021.

Mixers are legal

In the report, Chainalysis laments that mixers are legal “despite their utility for criminals.” In 2020 FinCEN, the Financial Crimes Enforcement Network said that cryptocurrency mixers are legal and considered money transmitters under the Bank Secrecy Act (BSA) and they must comply with the same regulations as other money transmitting services. These regulations they must comply with include maintaining a strong anti-money laundering compliance program and following “Know Your Customer” (KYC) rules for Money Services Businesses.

“Given that increased privacy is the whole point of using a mixer, it seems unlikely that one could implement those compliance procedures and retain its user base. “

Types of Transactions

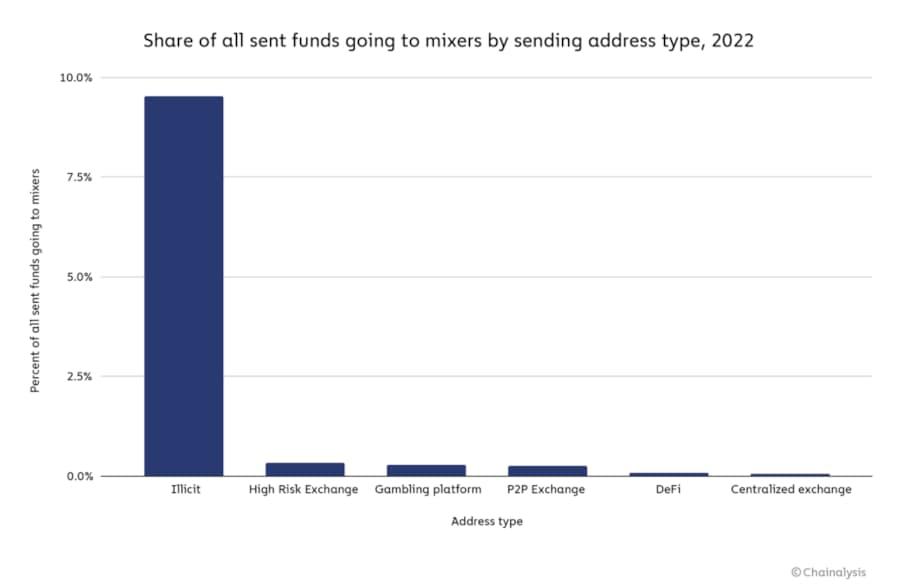

So far, in 2022, 23% of funds sent to mixers came from a cryptocurrency address associated with illicit activity. Illicit transactions accounted for just 12% of mixer activity in 2021.

According to Chainalysis these are the categories of illicit activity they tracked.

Terrorism financing

Scam

Fraud shop

Sanctions

Ransomware

Cybercriminal administrator

Stolen Funds

Child sex abuse material

“What stands out most is the huge volume of funds moving to mixers from addresses associated with sanctioned entities, especially in Q2 2022.”

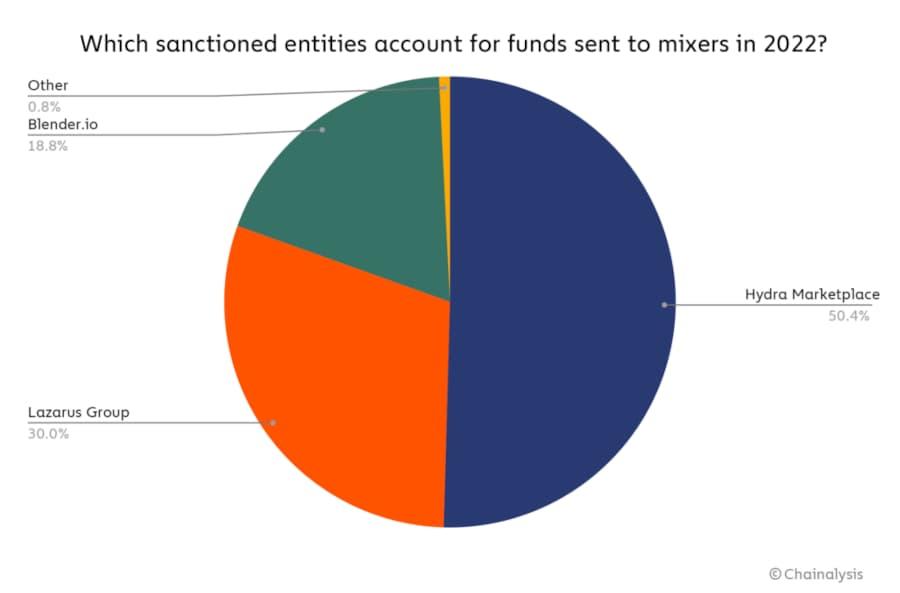

In April 2022 (Q2), the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Hydra Market. Transactions from addresses linked to Hydra Market accounted for 50.4% of all funds moving to mixers from sanctioned entities in 2022.

Chainalysis, which is a neutral source when it comes to discussions about financial privacy, believes that mixers “present a difficult question” to “members of the cryptocurrency community.”

“Virtually everyone would acknowledge that financial privacy is valuable, and that in a vacuum, there’s no reason services like mixers shouldn’t be able to provide it. However, the data shows that mixers currently pose a significant money laundering risk…”